Whether you’re just starting out in investing or are looking to expand your portfolio, you’ll have thought about the reasons why you want to invest.

Maybe you want to help with your child’s university fees or a deposit on their first house? Maybe you are looking to retire sooner than planned and hope investments will supplement your pension income?

Whatever your reasons for investing, your decision should be based on your circumstances and your own long-term financial goals.

The opportunity to increase your net worth can be a tempting one, but you’ll need to consider a few important factors. If you still have questions or you are unsure about your investment choices, speak to us. We can help to ensure you make the right investment choices for you.

What are you investing for?

Investments are intended for the long term, but it still helps to have a focus. Understanding your goal – and its timescales – will help you think about the level of risk you are willing to take.

If you want your investment to provide university fees for a newborn child, for example, you’ll have a minimum investment term of around 18 years.

Investing in the stock market over that term could deliver healthy returns but with your child’s education as the goal, your attitude to risk might be low.

If you’re investing for your own retirement, and it is still decades away, you might be willing to take more investment risk, at least to begin with.

Taking risks during an accumulation phase can lead to good returns but consider lowering the risk profile of your investments as your retirement date nears. This will help to prevent large losses at the worst possible time.

Understanding your attitude to risk

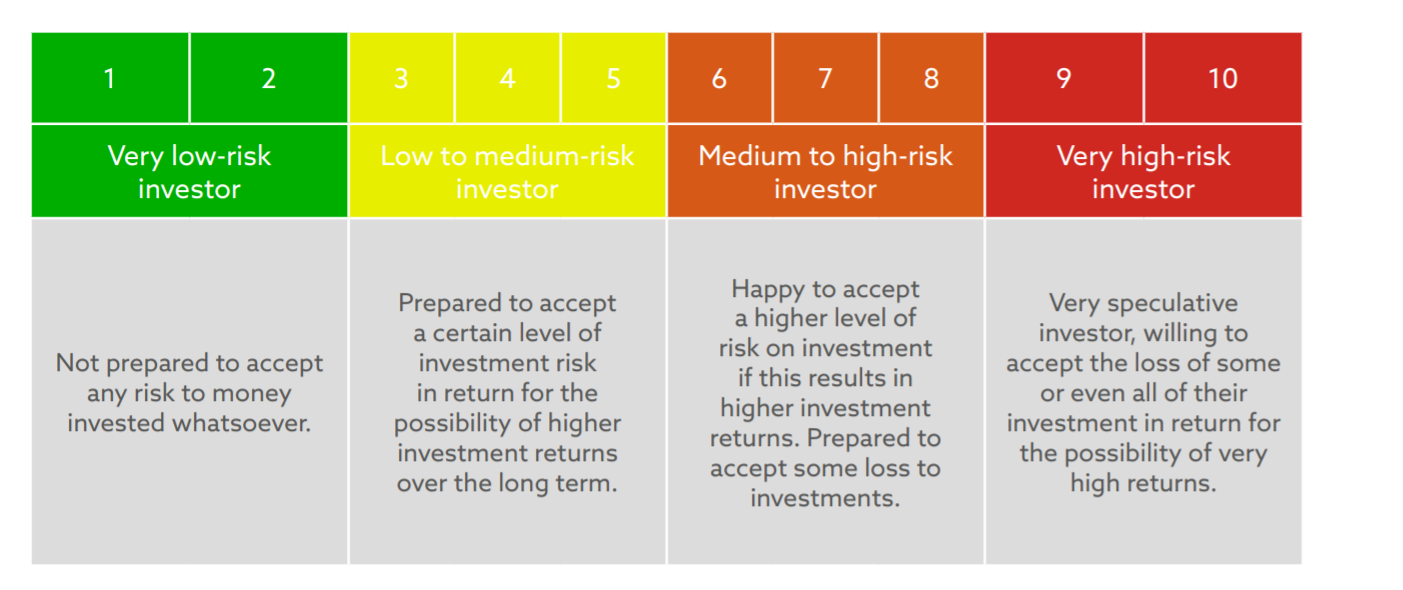

By asking a few simple questions, we can begin to help you understand your attitude to risk.

In the below table, one indicates a low-risk investor, ten a high-risk one. Wherever you fall on the scale, it’s worth noting too that a risk-rating of eight doesn’t mean every investment you choose should be an eight.

A diversified portfolio will spread risk across all levels, while still being aligned to your profile. More on diversification later.

Although there is no minimum term for investments, they should normally be made for a period of at least five years.

The stock market can be volatile and investing over the long term helps your money to recover from short-term market shocks. As previously touched upon, if you’re saving for retirement you won’t want to take unnecessary risks with your accumulated fund in the months before you retire.

Risk versus return

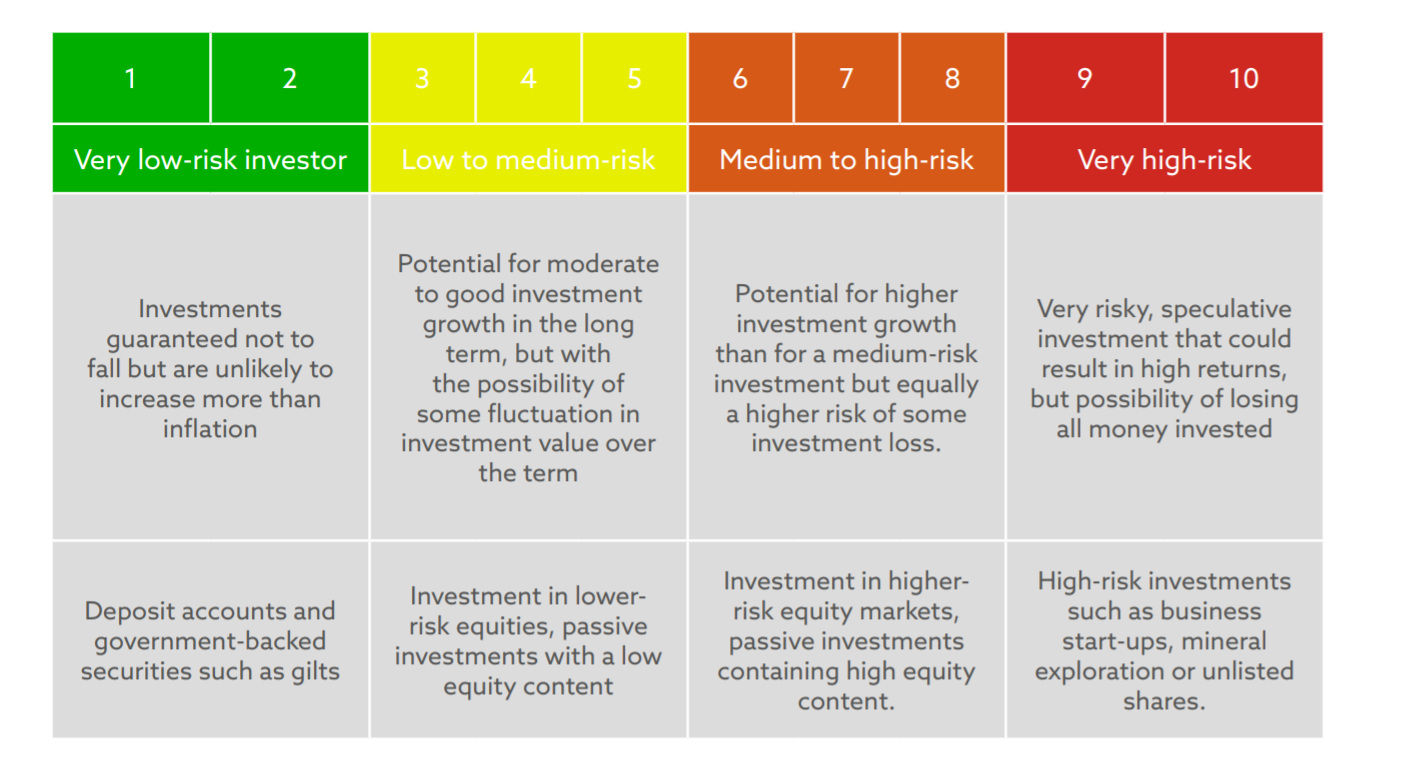

Different types of investment carry different levels of risk.

The value of the funds you place into a savings account won’t go down, whereas the shares you buy in a company carry more risk and you could lose your invested amount. Share prices can rise and fall on a daily basis but the greater risk means a potential for greater reward.

Maintaining a sufficient emergency fund is vital in any financial plan. However, with interest rates low currently, you’ll want to consider the impact of inflation too. Remember that your low-risk savings could be losing value in real terms and striking the right balance should be considered

Once you understand your risk profile, you can match it to the products that are right for you. We can help you with this.

The table gives an overview of investment risk per product, where one is the lowest risk and ten the highest.

As you can see, government-issued bonds are low risk, but you are unlikely to see large returns. Investing in high-risk company shares – such as for business start-ups – could see you achieve large returns. But there’s no guarantee that you’ll get back more than you put in. You could lose all your invested money.

The benefits of diversification

Diversification means spreading investment risk.

Whatever money you invest, it’s advisable to make sure that it’s not all invested in one specific investment market. Instead, spread your investments across different sectors.

Diversifying your investments in this way reduces investment risk. If a particular sector falls, only part of your fund is exposed and there is still potential for investment growth in other sectors.

Having a diversified portfolio means investing across different asset classes, across a range of industries, and in different parts of the world too.

As well as minimising risk, diversification can help consolidate gains already made, such as by switching pension funds into less risky asset classes as retirement approaches. Equally, when you’re in the accumulation phase, diversification spreads risk, but also the possibility of reward.

Unconstrained by industry, region, or asset class, a diversified portfolio can invest widely, hopefully seeking out large growth areas while spreading the possibility of large losses.

Get in touch

The investments you choose need to be right for you and your long-term plans.

We can help you match your investment choices to your attitude to risk and current portfolio, ensuring you achieve a risk versus return strategy aligned to your profile. Please contact us if you’d like to discuss the best investment option for you.

Please note:

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investment

Investment Trustee

Trustee