Typically, insurance is recommended for low frequency but high impact situations.

If your house burnt down, this would have a huge financial impact, but the chance of it happening is very low.

Loss of earnings could cause massive financial problems – especially if you have a mortgage and bills to pay. If you also have children to look after, statutory sick pay is highly unlikely to be sufficient.

There is a common misconception in the UK that our welfare state is enough of a safety net to cover time out of work. This is sadly not the case. Most people would be significantly worse off if they only had government support to rely on.

Another shift that has increased the need for insurance is the change in our working lifestyles. Traditionally, most people would work for one employer their whole working life. This would normally come with benefits including additional sick pay and life cover etc. As it is now far more common for people to either move from job to job or to be self-employed, this employer safety net does not exist in many cases.

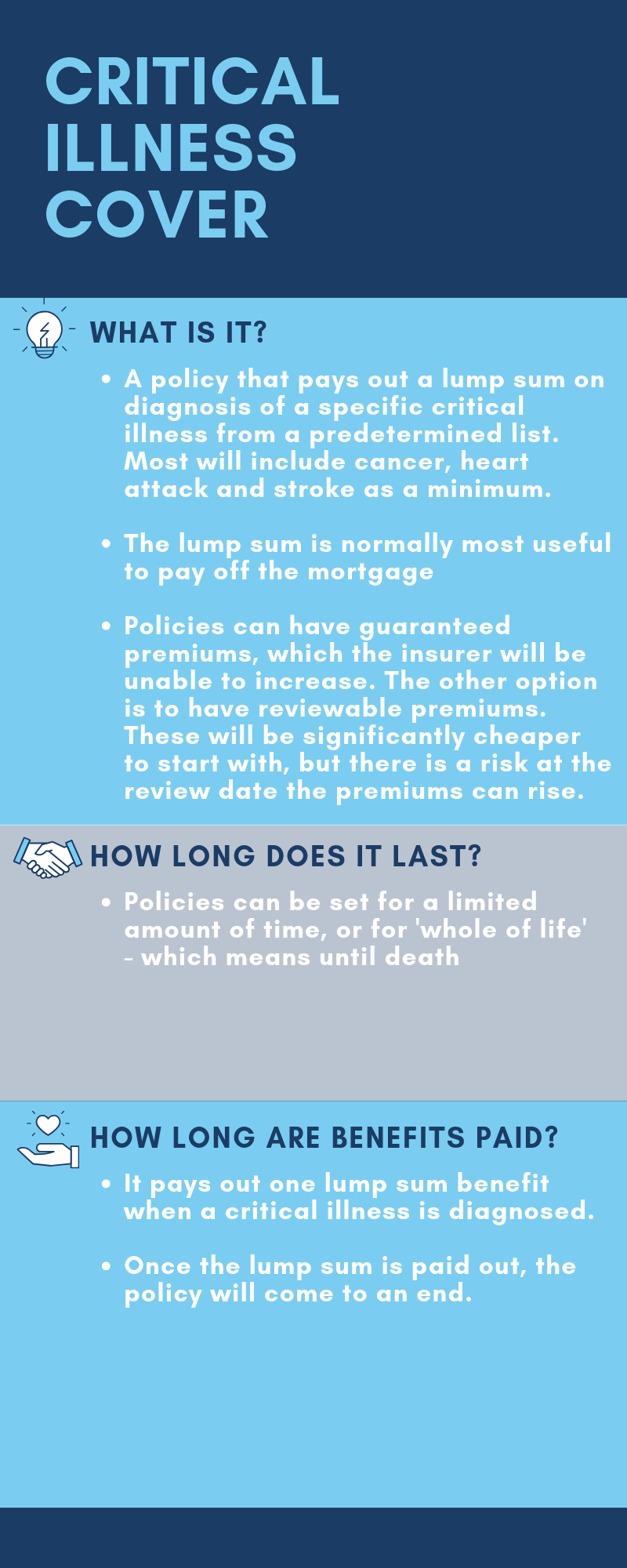

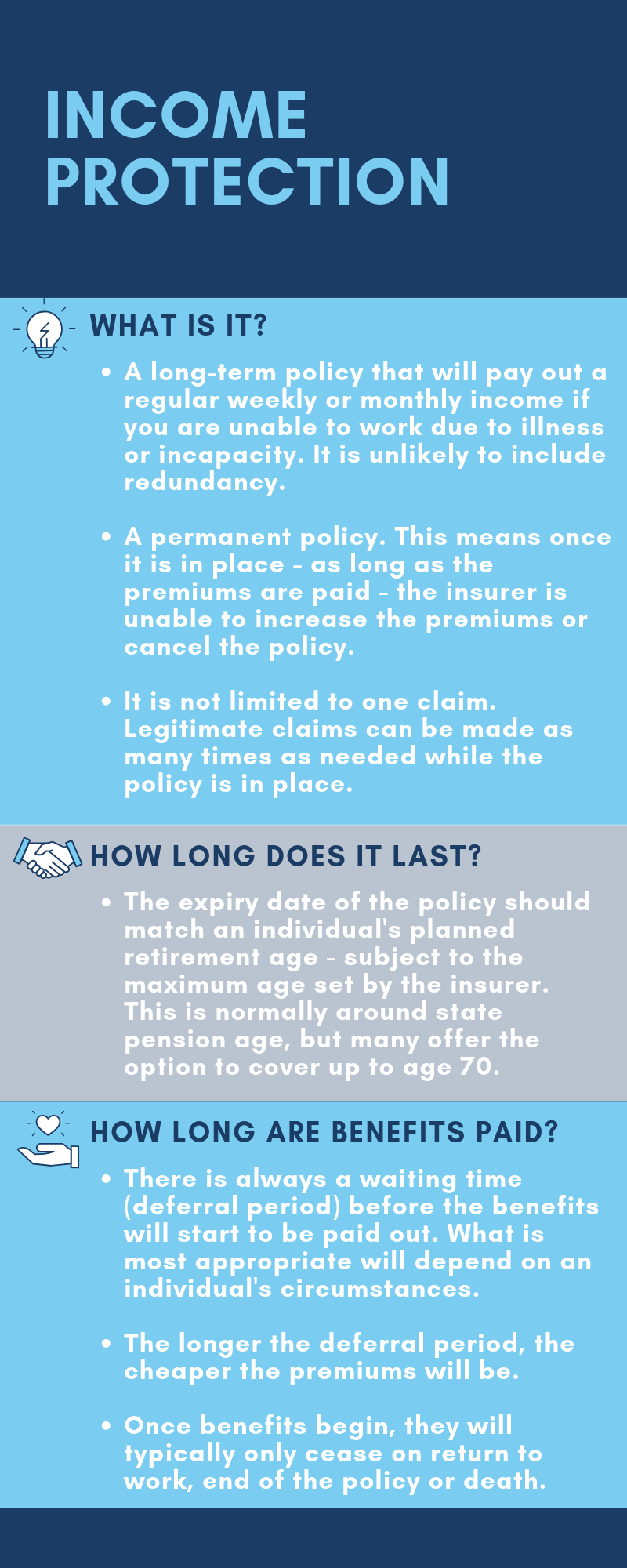

The most high impact situations that would lead to loss of earnings include long-term illness, disability or death. These events are best covered by long-term insurance policies such as income protection, critical illness cover or life assurance. Many people may be put off these types of insurance because of a misconception that they are too pricey. Insurers are constantly developing – so there are many variations within these policies which can be adapted to make it more affordable.

It is always better to have some cover than none at all.

Now, what about the recent loss of thousands of jobs for Thomas Cook employees?

Unfortunately, redundancy is a very tricky event to insure for. Although it is a ‘high impact’ situation, it is not classed as low frequency due to how impossible it is to predict its occurrence.

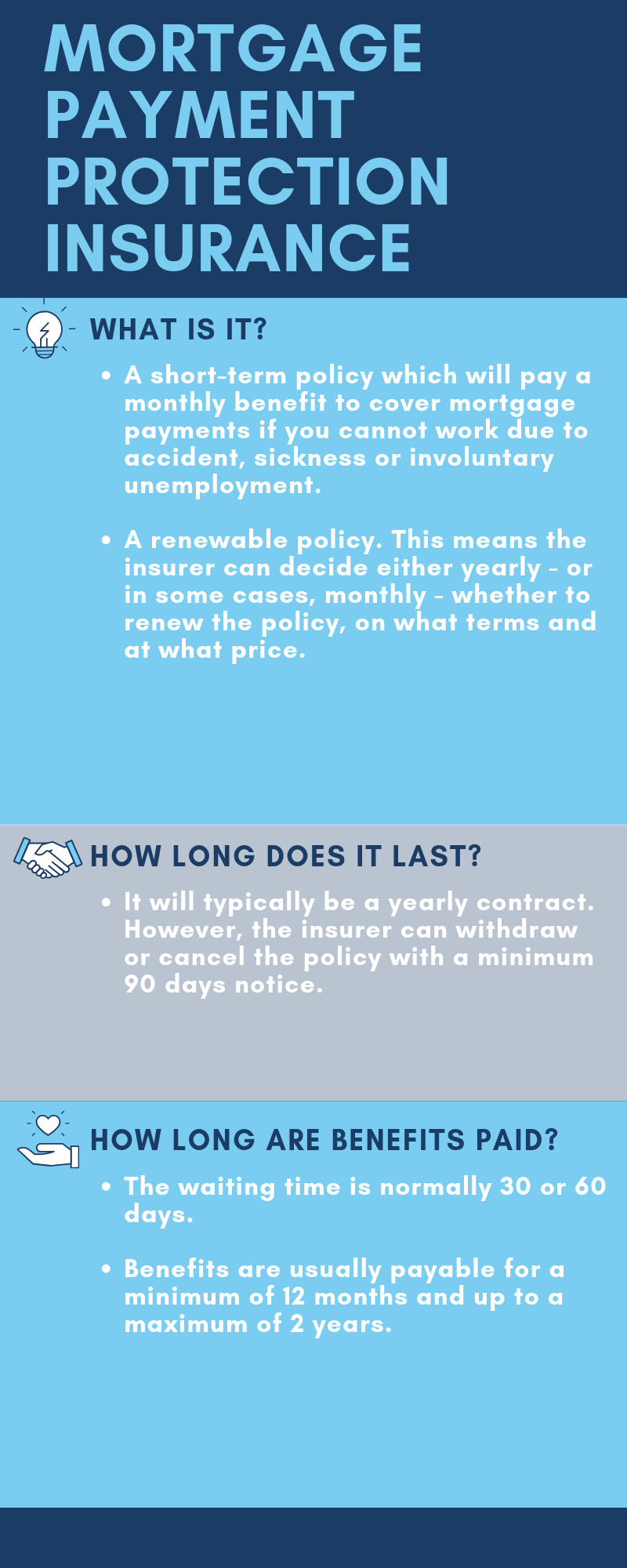

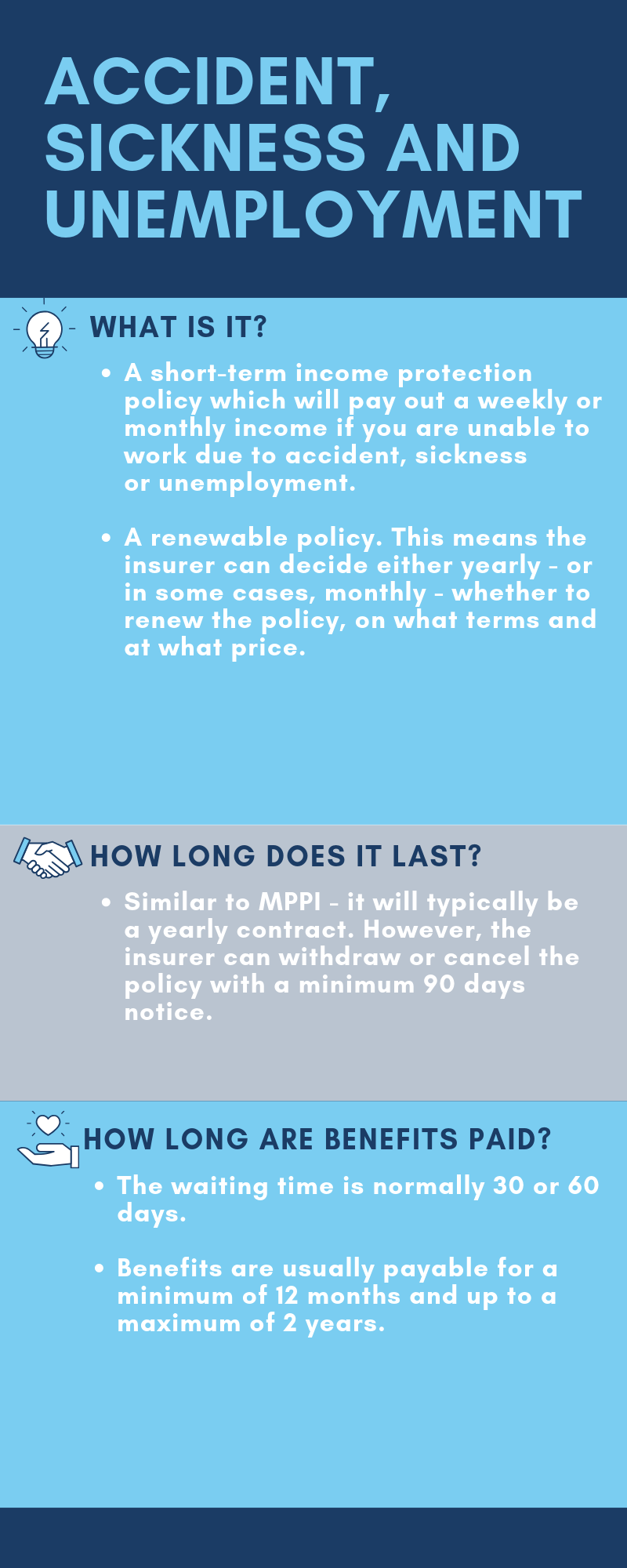

This means that it is highly unlikely it will be covered under a long-term income protection policy. There are some types of short-term insurance which would cover redundancy – but, it’s worth remembering, these will typically only pay out for a maximum of 2 years. There is more information on these options below.

Because long-term protection against redundancy is impossible, the most effective safety-net is personal savings. It is recommended to have an emergency fund that is somewhere between 3-6 months worth of earnings, depending on your personal circumstances. This doesn’t necessarily have to be in cash – it just has to be in a form that is liquid enough it can be accessed quickly when needed.

As most insurance policies will not pay out for the first few months after redundancy occurs – if you are confident you could find a new position quickly – having personal savings to cover the gap could be the most appropriate option anyway.

If you want to understand what protection is best suited to your personal circumstances and would like some expert, bespoke advice – the team here at Hartsfield can help. Please get in touch

Investment

Investment Trustee

Trustee