“Every time you spend money, you’re casting a vote for the kind of world you want”

Anna Lappé

There are a lot of different terms thrown around which are used interchangeably (sometimes incorrectly) to describe values-based investing. Essentially, the aim is to include environmental, social and governance (ESG) factors into investment decisions.

The two most common terms are ‘ethical’ and ‘sustainable’ investing.

Here is a diagram of the three main approaches available when using ESG factors in investment decisions.

(Robeco)

Ethical investing falls into the ‘exclusions’ category. Sustainable investing will typically take all three of these into consideration.

The ethical investing approach involves the blanket exclusion of certain industries because of the negative effect of their products, like tobacco companies and weapon manufacturers. Whereas, sustainable investing is more inclusionary and about supporting companies who are doing good and making positive choices. This means there is more flexibility within the sustainable approach.

It is a common mistake to think that choosing to invest sustainably must be made at the expense of performance. There is now plenty of evidence to challenge this – investing sustainably can actually improve returns. As well as this potential for enhancing returns, it could also minimise risk in the long-term. This is because as the world is changing, it is leading to ever increasing commerciality for companies to support the transition to a more sustainable society.

In other words – more demand for sustainability means those companies supporting it will grow, probably at the expense of other non-sustainable companies.

At Hartsfield we have called our values-based model portfolios our ‘ethical range’. Although they contain ethical funds, which exclude negative industries (negative screening), they do also contain sustainable funds. These make a difference by adding something to the community, or working towards a positive environment or social change (positive screening).

Because of this use of a mixture of positive and negative screening, we will soon be updating the name of our ethical portfolios to more accurately reflect their sustainable nature.

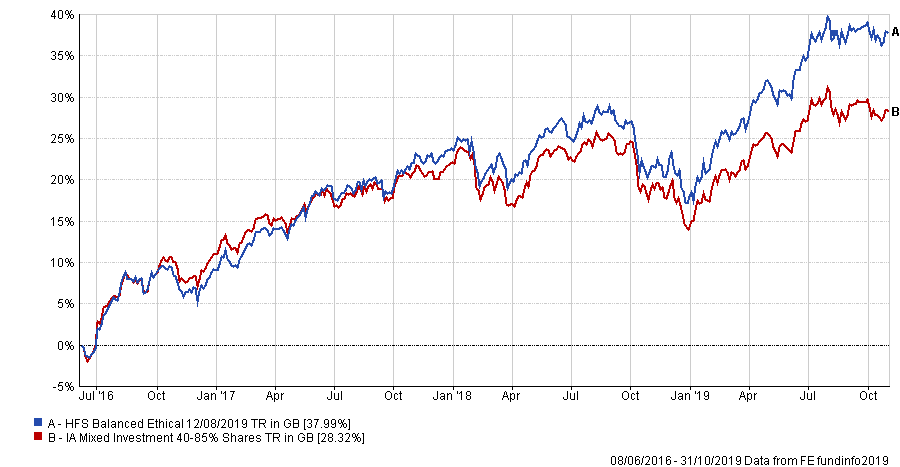

This is how our Balanced Ethical portfolio has performed since inception. We now also offer 4 alternative portfolios across the full range of risk strategies.

If you would like some advice on investing sustainably, the team here at Hartsfield can help.

Investment

Investment Trustee

Trustee