Barclaycard recently confirmed that Britons spent more than £40 billion online on non-essential items during the first lockdown. That’s £770 per person.

While it took seven years for the online share of retail spending to rise from 9% to 19%, the Office for National Statistics confirmed last year that in the first four months of 2020 it jumped from 19% to 33%.

As later lockdowns followed, our online shopping habits continued.

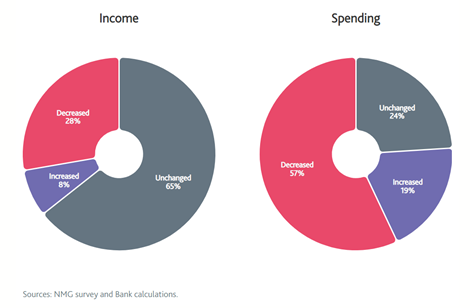

While those made redundant or furloughed struggled to make ends meet, the Bank of England confirms that 65% of the UK experienced no change in income.

As online shopping grew, anxiety about our health, job worries, and concerns for our children’s education also led to a rise in emotional spending.

But what is “emotional spending”? What can you do to keep it in check? And how could it be affecting your finances long-term?

Here’s your guide.

Allowing your emotions to dictate your spending habits might offer a quick fix

Emotional spending, or “retail therapy”, is when you buy something based on how you feel emotionally, rather than through need or even desire for the thing you are buying.

Over the last twelve months, you might have been feeling anxious about money, job security, or the virus itself. You might have been bored, in need of cheering up or wanted to give yourself something to look forward to.

If you turned to online shopping at any point when you felt this way, you may well have succumbed to emotional spending.

Looking after yourself both physically and mentally is vital and retail therapy can help, in moderation. It can boost your mood, at least in the short term, but you must keep track of your individual purchases and how much you are spending.

This should help to ensure you spend within your means and don’t detrimentally impact your finances longer-term.

There are several straightforward ways to keep your emotional spending in check

Whether the pandemic has seen you struggling financially or able to save more than usual, unnecessary spending could make it harder to achieve your long-term goals.

A short-term mood boost is great, but might the money you spend on retail therapy be better off as a contribution to your pension or a deposit into an ISA account, for example?

There is no harm in treating yourself now and again but watch out for signs that it might be getting out of control.

Here are some things to consider:

Understand what your triggers are

If you find yourself buying things you don’t need or want, one way to curtail your spending might be to think about what is triggering your spending.

It might be boredom, worries about money, or work-related anxiety. Tackling these issues directly should help.

You might start a hobby that allows you to interact with other people or talk to someone about your work or money worries.

Give yourself a cooling-off period

Internet shopping makes it easy to spend money. You can fill your virtual basket from the comfort of your own home, and proceed to checkout and payment effortlessly, often with just one click.

One simple way to curb your spending might be to give yourself a cooling-off period.

Complete your virtual window shop, adding items to your basket only if you are sure you want them, but don’t check out. Instead, wait 24 or even 48 hours and then revisit your basket.

If you don’t want or need what is in there, there is a good chance the potential purchases were the result of emotional shopping.

Delete the items you don’t want and be sure to give yourself this cooling-off period every time.

Create barriers to spending

Creating barriers will make online shopping harder. You might turn off one-click shopping, delete your card details, or remove apps from your phone that make spending easier.

Keeping away from electronic devices if you are experiencing one of your identified triggers should also help. Ban yourself from browsing shopping sites in bed, or after drinking alcohol, for example, and you might find your spending drastically reduced.

Simple budgeting tips can help

You might try these simple budgeting tips to help you keep track of your spending and stay on top of your purchases.

Pay your future self first

Put simply, this means paying bills, contributing to your pension, and putting money into savings before you start spending on non-essential items.

Put money aside for your future self first, budget for the rest of the month, and then decide what you need in the present.

Consider putting some money aside for spending on yourself and be sure to stick to that limit.

Keep a track of your cashflow

Be sure to keep track of your spending. Knowing what your monthly incomings and outgoings are will allow you to decide how much money you have left to treat yourself.

Looking back through previous bank statements or downloading apps such as Monzo will allow you to track your cash flow. You might spot trends in your emotional spending that help you to identify your triggers and cut back.

Speak to us

We can help you manage your money in a tax-efficient way while putting a plan in place that aligns your finances with your goals and aspirations for the future.

Get in touch

Please get in touch and find out how our team of expert financial planners can help you.

Investment

Investment Trustee

Trustee