The FCA’s Financial Lives 2020 survey confirmed last month that almost three in five (58%) of those who retired between March and October last year did so because of Covid-19.

The report suggests that struggling to cope financially when the pandemic hit was partially due to retirees’ poor engagement with retirement planning.

A good retirement plan includes an emergency fund and protection policies designed to maintain your financial stability even when times are tough. This may have prevented you from dipping into your pension savings earlier than planned.

If you were tempted, though, remember that there are long-term ramifications to taking a pension early and some great reasons to delay taking your fund for as long as possible.

1. Passing on your pension wealth tax-efficiently

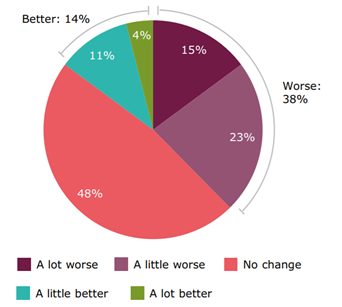

The pandemic has affected everyone’s finances differently. The FCA looked at the impact of Covid-19 on adults’ financial situation and found that while 48% saw no change, 38% reported being worse off. Only 14% saw their circumstances improve.

Source: FCA

It is important to remember that whatever external factors create financial uncertainty or cause stock markets to crash, it is your individual goals that matter. If your long-term aspirations haven’t changed then your plan needn’t either.

If you are one of the fortunate 14% who saw your finances improve, you might be saving and investing more, or contributing more toward your pension. Rather than worrying about taking it early, you might ask yourself if you need to take it at all?

Current Inheritance Tax (IHT) rules state that unused pension funds remain outside of your estate. This means they can be passed on tax-free in some circumstances.

If you die before age 75, unused funds can usually be passed on to your chosen beneficiary tax-free. If you die after age 75, any unused pension fund can still be passed on but there will be tax to pay at your beneficiary’s marginal rate.

Be aware that you will need to choose a beneficiary through your pension provider, rather than through your will.

If you can afford to hold off on taking your pension, it can be a tax-efficient way to pass your wealth onto the next generation.

2. Triggering the Money Purchase Annual Allowance could impact future saving

Even if you only want to access a small part of your fund – to pay bills in the short term or to help a loved one struggling financially – you’ll need to think about the long-term consequences of that decision.

The pension Annual Allowance is currently £40,000 (or 100% of pensionable earnings, if lower). This is the amount you can contribute to your pension each year while still receiving tax relief.

Taking taxable defined contribution (DC) benefits in certain “flexible” ways could trigger the Money Purchase Annual Allowance (MPAA). The MPAA reduces your Annual Allowance from £40,000 to just £4,000.

Once you trigger the MPAA you can’t reverse it. If you are still some way from full retirement, and you expect to continue making contributions, you’ll need to seriously consider the impact of triggering the MPAA.

Limiting your contributions means you’ll find it much more difficult to grow your retirement fund, and you won’t be able to take advantage of compound growth. We can confirm if your chosen option would trigger the MPAA so get in touch with us before making a decision.

Also be aware that if you are a high earner, you might already have a reduced Annual Allowance due to the pension taper. Again, contact us if you are unsure which allowance applies to you.

3. Be aware that you might push yourself into a higher tax bracket

If the pandemic has left you worried about your invested funds, you might be tempted to access them as soon as possible. Remember the importance of sticking to your long-term plan and avoiding emotional decisions when times are hard.

Accessing large chunks of your retirement fund, as a lump sum, for example, can have tax consequences.

Although a portion of your pension withdrawal will likely be tax-free, the majority will be taxed as income. Taking a large amount in one go could push you into a higher tax bracket and lead to an unexpected bill.

If you feel you need to access a large amount, consider spacing it over the end of a tax year to lessen the tax impact.

Also, be aware that taking a lump sum via the uncrystallised fund pension lump sum option could see you emergency taxed. Although the overtaxed amount can be claimed back, this might be a lengthy process.

If you are accessing funds to help plug a short-term gap, such as time-sensitive bills, you might not receive the amount you expected straight away.

Get in touch

The pandemic might have had an impact on your finances in the present, but it is important to remain focused on your long-term plans.

Pensions are tax-efficient and making the most of this is one way your financial plan can help you reach your goals, allowing you to live your desired lifestyle in retirement.

If you have been tempted to access pension funds earlier than planned during the pandemic, please get in touch now. We can help you find a way to manage your finances in the short term while still living the retirement you want.

Please note

The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Investment

Investment Trustee

Trustee