Inflation is currently at a 40-year high, with the Bank of England predicting an October peak of 13.1%. The Bank recently raised its base rate to 1.75%.

With the highest rate for an easy access savings account currently 1.56% (according to Moneyfacts figures as of 8 August 2022), all easy access accounts fall below the current base rate.

This means that your cash funds are effectively losing value in real terms.

You might turn to investments. While your funds have the potential to make inflation-beating returns there are risks attached and several mistakes you’ll want to avoid.

Here are just five of them.

1. Not starting early enough

While it’s never too late to start investing, the earlier you start putting money aside the better.

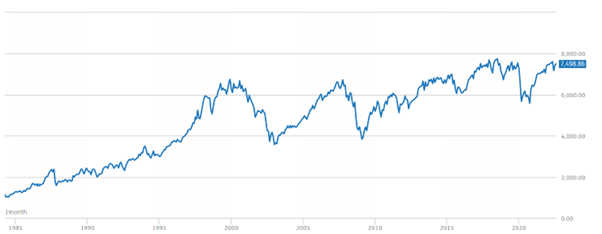

The stock market rises and falls daily, and while past performance is no guarantee of future success, the general trend of the market is upward.

FTSE 100 since April 1984:

Source: London Stock Exchange

Despite the downturns representing the war in Iraq (2003), the global financial crisis (2008), and the onset of the coronavirus pandemic (2020), the upward trajectory is clear.

A long-term goal (see point 2 below) gives your investment time to ride out short-term periods of volatility and benefit from the investment growth that follows.

Also, the longer your investment period, the greater the effects of compounding.

Effectively interest on the interest you earn, compounding can greatly increase the value of your fund over time, so the sooner you start the better.

2. Not having a long-term goal in mind

Without a long-term goal in mind, your investment will lack focus.

It’s important to remember that investing isn’t a race to make the most profit, it’s a risk-managed journey to a pre-elected goal.

Having this endpoint to focus on will help you to stay focused and unemotional when the market suffers from short-term volatility.

3. Failing to diversify

When global events create uncertainty, this is reflected in markets.

One way to spread investment risk is to diversify and it’s an approach that we take with all our Hartsfield Investment portfolios.

Diversification means spreading your investment over asset classes, sectors, and geographical regions.

This spreads your exposure to risk over multiple areas and it is hoped that should one class, sector, or region fall, this drop will be offset by a rise in another area.

It is because of diversification that a 5% drop in the FTSE 100, for example, doesn’t automatically equate to a 5% drop in the value of your investment.

4. Succumbing to unconscious biases

There are several investment biases that you could succumb to. Being aware of them is the first way to protect yourself.

Broadly, biases can be split into two categories: cognitive and emotional.

Cognitive biases

These are based on preconceptions and might include confirmation bias, trend-chasing, and familiarity bias.

These could see you ignore opinions that don’t match your own or put faith in a stock simply because you are familiar with it. You might also succumb to a kind of herd mentality, losing focus on your own goals and following the pack.

Emotional biases

On the other hand, emotional biases are based on personal feelings and might be more emotional. These include loss-aversion, self-attribution, and endowment bias.

You might place greater emphasis on avoiding losses than making gains, place too much confidence in your own decisions, or hold onto poorly performing stock from a misplaced sense of loyalty.

5. Failing to seek professional advice

At Hartsfield, we offer a range of portfolios – including a responsible portfolio aligned to the UN’s Sustainable Development Goals.

We can help you to choose the right portfolio for you and then we’ll review it regularly. This ensures that it still aligns with your goals, whatever happens in the wider markets. If we need to rebalance your portfolio, we will.

With decades of combined experience, you’ll be sure that your investment is in safe hands.

Get in touch

Hartsfield Planning can help you stay on track to achieve your long-term goals whatever happens in the wider economic world. If you would like to discuss any aspect of your long-term financial or retirement plans, please get in touch and find out how our team of expert planners can help.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Investment

Investment Trustee

Trustee