Reaching retirement is a massive life milestone and you’ll no doubt have pension arrangements in place, whether privately or through a workplace scheme. You might even be contemplating increasing your contributions as you head into the new year.

There are many good reasons to do this, some more obvious others. Here are four, including some you might not have thought about.

1. You’ll take maximum advantage of compounding

The effects of compounding become more pronounced over time so starting contributions as early as possible is important. But even a small percentage increase in the amount you put aside can make a big difference thanks to compound growth.

When you invest money, you are looking to make returns on your investment. The effects of compound growth mean that you make returns on that growth too.

Pay £100 into your pension and if you earn 5% interest in the first year, you will have £105. In year two, you still receive 5% interest but now the amount you receive is £5.25.

Up your monthly contribution by just 1% and over the course of your investment compounding could help to give you the retirement you dream of.

2. The minimum auto-enrolment contribution might not be enough

In the first six years since its introduction in 2012, auto-enrolment saw the proportion of eligible staff saving into a workplace pension increase from 55% to 87% according to The Department for Work and Pensions.

The minimum contribution has risen during that time and is 8% for the 2020/21 tax year. Your employer contributes a minimum of 3%, leaving you to pay the remaining 5%.

You also receive tax relief on your contribution. For a basic rate taxpayer, this amounts to an extra £20 for every £100 you contribute. If you are a higher or additional rate taxpayer, you also receive basic rate relief, but can claim back additional relief via your annual tax return.

Research by Which? has shown that you’ll need around £25,000 a year as a household to live a ‘comfortable’ retirement. For a luxurious retirement, the figure rises to £40,000. A minimum auto-enrolment contribution is unlikely to provide this level of income, even with the State Pension factored in.

We can help you formulate a retirement plan that is realistic and aligned with your goals, so get in touch if you’re considering upping your pension contributions.

3. Upping your pension contributions could increase your Personal Allowance

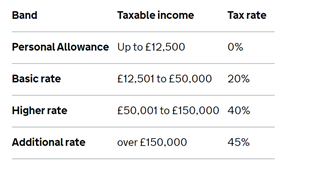

The standard Personal Allowance is £12,500. This is the amount of income you do not have to pay tax on and it reduces by £1 for every £2 of income over £100,000. You do not get a Personal Allowance at all on taxable income over £125,000.

Source: Gov.uk

If you earn between £100,000 and £125,000 your tax rate becomes effectively 60%, as you pay tax on both the £2 over the threshold, and the £1 reduction.

Your adjusted net income of £100,000 is your total taxable income less some deductions including gift aid donations and gross personal pension contributions. Therefore, making a pension contribution could reduce your ‘adjusted net income’ and see you regain all or some of your Personal Allowance.

4. Paying more into your pension could increase your Child Benefit

You can receive Child Benefit for a child under 16 (or under 20 if they are in full-time education or training). Only one person can receive Child Benefit and you may be liable to pay some back in Income Tax if you or your partner earns over £50,000.

For income between £50,000 and £60,000, Income Tax is charged as a proportion of the Child Benefit received. You’ll no longer receive the benefit if you or your partner earns more than £60,000.

If you or your partner’s income is close to these thresholds you might consider increasing your pension contributions as a way of reducing your ‘adjusted net income.’

Making additional contributions to your pension means benefiting from a larger pot at retirement in the future and could mean receiving some, or all, of your Child Benefit now.

Get in touch

The more you save into a pension during your working life the more comfortable your standard of living will be in retirement. That means paying as much as you can afford and starting as early as possible. But there could be other benefits too.

Pension tax planning can be complicated so be sure to speak to us if you have any questions about your current contribution level or you are considering increasing it.

We can help you decide on an affordable contribution amount and put an attainable plan in place that aligns with your long-term goals.

Please get in touch and find out how our team of wealth management experts can help you.

Please note

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Investment

Investment Trustee

Trustee