During your working life, your financial plan will likely focus on building savings for your retirement. You will likely pay into a pension and investments so you can grow your wealth for the future.

However, once you near retirement age, you may need to start thinking about how you will use those savings to fund your lifestyle during retirement. For example, you may want to take lump sums from your pension, transfer it into flexible drawdown, or purchase an annuity to generate a regular income.

This process of drawing from your accumulated savings to generate an income in retirement is known as “decumulation” and it can be complex to navigate without professional assistance.

Unfortunately, a new study reported by the Actuarial Post found that more retirees are making at-retirement decisions without taking advice.

Indeed, around 41% of the decumulation products sold in 2022 were sold without any advice.

This is a potential issue because, if you do not plan accordingly, you may pay more tax than you need to, or risk running out of savings during retirement.

Additionally, you may face greater challenges in 2023. The cost of living remains high and other outside factors such as volatile markets could make it more difficult to draw from your accumulated savings in a sustainable way.

As such, you may be unprepared for the transition into retirement, and you wouldn’t be alone in this.

According to MoneyAge, 57% of 55 to 64-year-olds do not know how much they have in their pension and 64% don’t feel confident about their retirement.

Fortunately, taking advice can help you ensure you draw your pension in the most efficient way and generate enough income to fund your lifestyle.

Here are three reasons why advice is crucial when and after you retire.

1. Life expectancy is growing

Predicting how many years you will need to fund your lifestyle for is one of the biggest challenges of retirement planning.

If you draw too much income early in your retirement, you risk depleting the savings you have available later in life. On the other hand, if you are too conservative, you may have to make compromises in terms of your lifestyle.

Unfortunately, in 2023 and beyond, it may be more difficult than ever to predict how long you will live for and how much income to draw each year as life expectancies continue to rise.

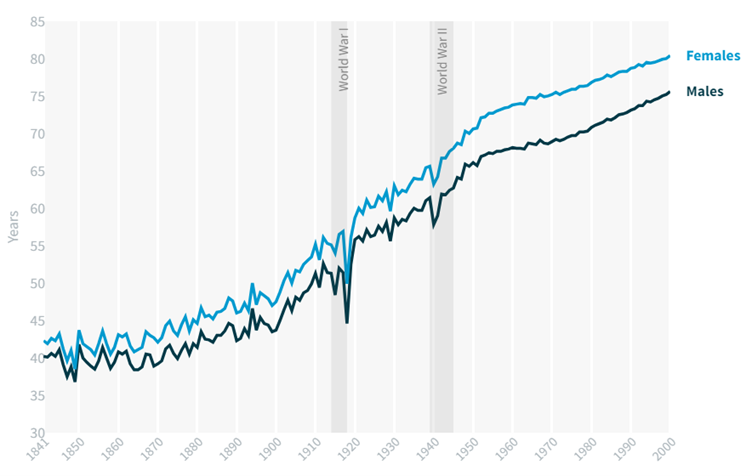

Although the pandemic slowed the increase, to some extent, life expectancy for both men and women is steadily growing, as demonstrated by the graph below:

Source: The King’s Fund

As you can see, there is a clear upward trend and as healthcare provisions improve, it is likely that this increase could continue. As a result, you may need to fund your retirement for longer than you think.

Indeed, Canada Life reports that people underestimate their own life expectancy – both men and women predicted they would live until 80, while the average life expectancy is 84 for men and 87 for women.

It is also important to consider the potential cost of health problems as life expectancy grows, and research shows that poor health is becoming more prominent.

The King’s Fund reports that “healthy life expectancy” is growing at a slower rate than overall life expectancy. As a result, you may live longer, but you are likely to spend more of those years with health problems of some kind.

Consequently, you risk running out of savings if you underestimate your own life expectancy, or you fail to plan for the cost of later-life care.

As such, it is crucial that you ensure your withdrawals are sustainable, so you can continue to take the income you need later in life. You may also need to calculate the potential cost of care and ensure that you are able to afford this.

A financial planner can help here as they will be able to create a cashflow plan to show you how long your savings could last, depending on the level of income you draw. Additionally, they can forecast the effects of a large expense, such as care costs, on your financial plan.

2. The effects of inflation

Over the last two years, the cost of living has been rising and you may have noticed an increase in your monthly outgoings.

However, you may not have considered the effect that high inflation could have on your retirement income in the medium to long term.

Your cash savings, for example, could lose value in real terms, so when you come to draw on them to fund your lifestyle, their spending power has reduced.

This could happen because inflation was 6.8% in the 12 months to July 2023, according to the Office for National Statistics (ONS).

The best two-year fixed-rate ISA interest rate, on the other hand, was 5.9% on 8 August, according to MoneySavingExpert, so your cash savings are likely growing slower than the rate of inflation.

In practice, the result is that, a year from now, you may not be able to buy as much as you can today.

Additionally, you will likely need to draw a larger income from your pension to maintain your lifestyle if inflation remains high. This could mean that you deplete your retirement savings faster and you risk running out of money.

That’s why it is so important to account for the effects of inflation when calculating how much to draw from your retirement savings.

Working with a financial planner may also be beneficial as they can help you explore options for protecting your wealth against inflation.

3. Market fluctuations

Economic uncertainty often brings big market fluctuations along with it, and this could affect the value of your pension and investments.

For instance, according to the Guardian, the FTSE 100 fell to its lowest closing level in 2023 on 6 July.

While markets tend to bounce back in the medium to long term, and your investments may continue to show positive returns, you may still need to consider how these short-term dips affect your pension.

Typically, when markets drop, you may have to sell more units of your pension to generate your chosen level of income.

As such, your pension savings may deplete faster than expected during times of market volatility.

Additionally, if you sell more units, you have fewer units left in your pension to appreciate when markets recover. This could mean that you spend your pension savings faster during a market downturn and miss out on valuable growth later too.

Fortunately, you can plan for this, but you may need to rethink the way that you draw from your pension. For example, you could take a slightly smaller income during periods of market volatility.

Alternatively, you could take more from your cash savings during times of market volatility, and leave more of your pension invested until markets recover, if possible.

Speaking with a financial planner may help you determine the most efficient way to draw an income from your retirement savings during a period of economic uncertainty.

Get in touch

Deciding how to draw an income from your retirement savings can be challenging, and we are here to support you.

Please get in touch to find out how our team of VouchedFor top-rated planners could help today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Investment

Investment Trustee

Trustee