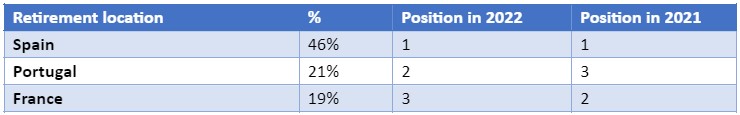

A recent survey confirms that Spain is the most popular destination for Brits retiring abroad. Spain beats Portugal into second place, with France in third.

There are many reasons why you might be looking to emigrate in retirement – including better weather, a more relaxed lifestyle, and a lower cost of living.

But what does retiring abroad mean for your State Pension?

This is an especially important question in light of a recent PensionsAge report that found that almost one-third (31%) of retirees expect to rely on the State Pension as their primary source of retirement income.

Keep reading to find out about your State Pension entitlement and how it could be affected if you decide to retire overseas.

Understanding your State Pension entitlement

You become eligible for the full State Pension when you have 35 “qualifying years” of National Insurance contributions (NICs). Qualifying years are those in which you:

- Worked and paid NICs

- Received National Insurance credits

- Paid voluntary NICs.

If you have at least 10 qualifying years you’ll receive a State Pension amount based on the number of qualifying years you have. Less than 10 qualifying years means that you won’t be eligible for any State Pension.

Check your National Insurance record to see how many qualifying years you have.

The full new State Pension for the 2022/23 tax year stands at £185.15 a week or £9,627.80 a year. Not only that, but the amount you receive increases regularly thanks to the triple lock. Your State Pension rises each year in line with the higher of:

- Earnings growth

- Price inflation

- 2.5%

While the State Pension is unlikely to be your main source of retirement income, it is a solid foundation on which to base your retirement plans. That’s why it’s so crucial you understand what will happen to it if you move overseas.

Moving overseas could stop your State Pension from rising each year

If you are eligible for or receiving a UK State Pension and choose to move abroad you can still receive your State Pension. Whether it continues to increase each year in line with UK rises, though, will depend on where you move to.

Move to an EU country – including Brit’s top picks of Spain, Portugal, and France – and your pension will still increase.

Countries in the European Economic Area (EEA) are also eligible for State Pension increases. EEA countries are effectively those in the EU plus Iceland, Liechtenstein, and Norway.

Gibraltar, Switzerland, and any country that has a social security agreement with the UK count too, but Canada and New Zealand are exclusions.

Taking the time to research the country you are moving to is key. You’ll need to factor the State Pension into your retirement budget, so understanding whether it will increase or be frozen could massively affect your budget. You should also let HMRC know that you are moving abroad as it could influence how you are taxed.

There are other important factors to consider too like house prices and the cost of living

Canada Life’s report found that nearly a quarter (23%) of UK retirees were unaware of reciprocal social security agreements. Just one-fifth (20%) knew which countries had agreements in place.

Interestingly, though, each country in the top three has such an agreement.

Source: Canada Life

Opt for one of these and your pension will continue to increase in line with UK rises.

You might also find that house prices and the cost of living are cheaper, with European countries taking different approaches to soaring inflation and rising bills.

Survey responders over 50 anticipated an average monthly income of £1,430 would be needed to retire abroad. This is compared with £1,931 deemed necessary for the same retirement lifestyle in the UK.

Finally, it’s worth considering these two points. If you move overseas to work before you retire, you could find yourself eligible for a State Pension in both countries.

It’s also important to remember that if you move to a country without a reciprocal agreement – thereby freezing your State Pension – but later move back, your pension will jump to the current rate.

Get in touch

The effects of the pandemic and Russia’s war in Ukraine (among other factors) are causing prices to soar across the globe. You may find, though, that the UK is still a more expensive country to retire in than some of its closest neighbours.

As well as lifestyle benefits like the weather and quality of life, there could be economic advantages to retiring abroad.

You’ll need to think carefully about your retirement income, including your State Pension, and the rules that exist in the country you are moving to. It’s also vital you let HMRC know.

Retirement is rife with important choices and moving overseas is a huge decision. If you would like to discuss the impact of emigrating on your long-term retirement plans, please get in touch and find out how our team of expert planners can help.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Investment

Investment Trustee

Trustee