When the new tax year started on 6 April 2023, many tax allowances reset, including your ISA allowance. In the 2023/2024 tax year, you can contribute up to £20,000 into an adult ISA, and use it to save or invest without being subject to Capital Gains Tax (CGT) or Dividend Tax.

By making full use of your ISA allowance, you can help to make your wealth as tax-efficient as possible and maximise the returns from your investments.

While many people typically wait until towards the end of the tax year to invest in an ISA, there are benefits of making your contributions early.

Here are two ways starting your ISA saving early in the tax year could maximise your wealth.

1. Give yourself more potential for growth

Depositing money in your ISA early in the tax year may give you more potential to generate investment growth on your wealth.

That’s because paying into a Stocks and Shares ISA at the beginning of the tax year compared with the end potentially gives you another 12 months’ worth of returns.

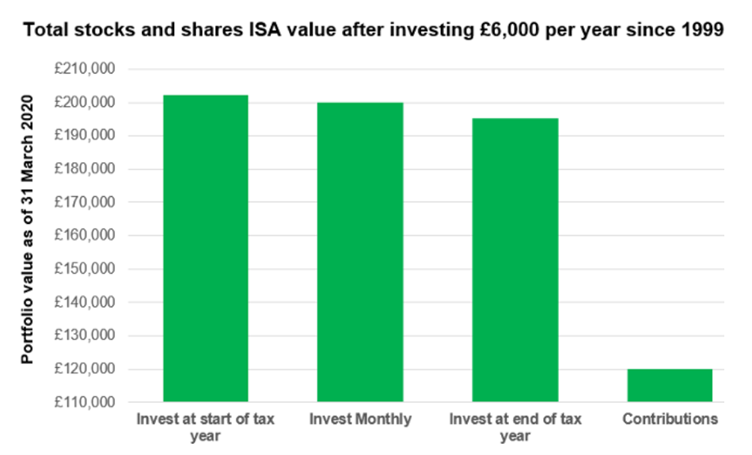

A study from Nutmeg demonstrates how much difference this could potentially make.

Their calculations show that if you invested £6,000 into a medium-risk Stocks and Shares ISA on the first day of the tax year between 6 April 1999 and 31 March 2020, your returns would be £6,969 greater than if you had waited until the last day of the tax year.

Source: Nutmeg

Paying in early means that you benefit from compounding on investment returns and that your wealth is invested for a longer period, and this can make a sizeable difference to the amount of growth that you see.

So, if you start your ISA savings at the beginning of the tax year, you give your investments longer to grow. Ultimately, this means that your wealth may appreciate more, and each year you benefit more from compound interest.

2. Make regular contributions to spread the cost and benefit from pound cost averaging

If you do not have a large enough lump sum to use your entire ISA allowance at the beginning of the tax year, making some early contributions could still be beneficial.

Indeed, calculations from Nutmeg found that if you had contributed £500 every month between 6 April 1999 and 31 March 2020, starting at the beginning of the tax year, your returns would be £4,694 higher than if you had invested the same amount as a £6,000 lump sum at the end of each tax year.

This means that you can potentially spread the cost of investing in your ISA across the year and incorporate it into your budget easily, while also still reaping the rewards of starting early.

You may also benefit from “pound cost averaging” when making regular contributions to your Stocks and Shares ISA.

As the value of investments fluctuates, there will be some months where stocks and units in funds may be expensive while, in other months, they could be cheaper. By starting at the beginning of a new tax year and making regular contributions, you are essentially buying some shares or units each month at different prices, potentially averaging the cost of your investments over time.

Cash v Stocks and Shares ISA

Using your £20,000 ISA allowance as early as possible may encourage better returns, but it is important that you consider which type of ISA is best suited to your goals – a Cash ISA or a Stocks and Shares ISA.

A Cash ISA is a tax-efficient way to save as you can contribute up to your £20,000 allowance each year without paying tax on the interest. You may also find a better interest rate than you would on an easy access savings account if you pay into a fixed rate Cash ISA – for example, as of 16 May 2023, Moneyfacts say that the best rate is 4.35%.

However, during a period of high inflation, the value of cash left in an ISA could be losing value in real terms as the interest you receive may not keep pace with the rising cost of living.

A Stocks and Shares ISA may help you combat this. Although there is no guarantee of investment returns, you may have more potential for growth that outpaces inflation, especially if you start contributions early in the tax year.

That’s why a Cash ISA may be more suited to short-term goals such as saving an emergency fund while a Stocks and Shares ISA may be better for reaching medium- to long-term goals like investing for retirement.

However, this all depends on your own personal goals and your attitude to risk, so it may be useful to seek advice.

Get in touch

If you need advice on how to use all your allowances in the most efficient way possible, we are here to help. Please get in touch and find out how our team of VouchedFor top-rated planners could help you grow your wealth.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Investment

Investment Trustee

Trustee