Your guide to keeping an emergency fund

A recent survey has found that almost half (46%) of UK retirees don’t have enough in their emergency fund. And yet, preparing yourself against the unexpected – whatever your stage in life – is vital.

It isn’t always easy to know how big your rainy day fund should be. And, in the current economic climate of high inflation and low interest rates, keeping the right amount in your emergency fund is even trickier.

Reports suggest that billions of pounds currently sits in savings accounts earning no interest. Meanwhile, the Financial Conduct Authority (FCA) is encouraging savers to invest, hoping to reduce the number of people with more than £10,000 in their bank account.

How do I build an emergency fund?

The government have announced several tax changes recently – a National Insurance and Dividend Tax rise as well as the suspension of the State Pension triple lock – and more changes could be imminent. The chancellor delivers his Autumn Budget on 27 October.

As the UK economy continues its slow recovery from the coronavirus pandemic and the government’s “furlough” scheme comes to end, now might be a great time to revisit your household budgeting.

You don’t need to build an emergency fund all at once so take time to understand your incomings and expenditure and decide how much you can realistically put aside each month.

Thinking about your cashflow might help you to identify areas where savings can be made. Maybe now is a good time to switch your energy provider or to cancel any unwanted subscriptions?

How big should my emergency fund be?

Ideally, your emergency fund should be between three and six months’ worth of household expenditure. Put aside as much as you can each month until you have this amount saved and be sure to keep it in a cash account that allows easy access so it’s available quickly whenever you need it.

The coronavirus pandemic showed how quickly the unexpected can happen and with far-reaching consequences. Knowing that you have an emergency fund in place will give you confidence and a sense of control.

Accidents, illness, job loss or a sudden unexpected expenditure won’t be financially daunting. Knowing the unforeseeable is covered financially means that you can concentrate on riding out the emergency, whatever form it takes.

What should I do with the rest of my cash savings?

Back in March, the Bank of England decided to drop its base rate to a historic low of 0.1%. This is bad news for savers who had already suffered a decade of low rates following the 2008 global financial crisis.

Currently, low rates are being compounded by rising inflation.

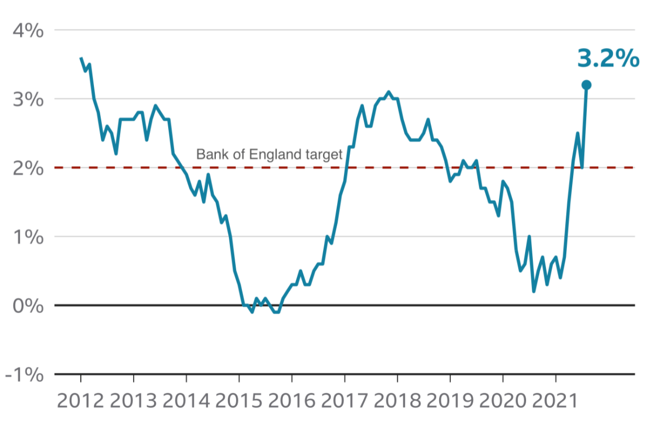

Source: BBC

The Bank of England has a target to keep inflation at 2%. Yet, a combination of rising demand for oil and gas, bottlenecks in deliveries exacerbated by Brexit, and the removal of Covid tax breaks for hospitality are all pushing up prices.

Inflation reached 3.2% in August and forecasts now predict it could reach as high as 4%.

How will inflation affect my emergency fund savings?

So, what is the knock-on effect of this for your cash savings? With interest rates languishing below 1% and the cost of living rising by more than 3%, your cash savings are effectively losing value in real terms. Now is a good time to seek help from one of our financial advisors who will take time to understand your personal circumstances before creating a tailored plan.

Keep an emergency fund set aside, but also consider investing some of your wealth. While investment carries a risk – your funds can fall as well as rise – long-term investment allows you to take advantage of the general upward trend of the markets.

At Hartsfield Planning, we can help you manage your investments in line with your risk profile. An investment gives you the chance to make inflation-beating returns and in the current economic climate, you might find that the biggest risk is taking no risk at all.

Figures from a recent Hargreaves Lansdown report, as published in MoneyAge, confirm that more than £246 billion currently sits in savings accounts earning no interest at all. Meanwhile, the FCA has launched an £11 billion campaign aimed at encouraging investment.

Sarah Pritchard, executive director of markets at the FCA and quoted by This Is Money says: “We want to give consumers greater confidence to invest and to help them do so safely, understanding the level of risk […] We are not saying investing is right for everybody, but we want those who could benefit to have the confidence to do so.”

Nearly 8.6 million Brits hold more than £10,000 in cash savings accounts that could provide greater rewards if invested.

Get in touch

Taking time to understand your cashflow will help you to put an emergency fund aside. Once you have, you’ll enjoy peace of mind knowing that you and your family will be financially protected should the unexpected happen.

You’ll need to bear in mind too, that once you have your emergency fund in place, any excess cash savings you hold might be better off elsewhere.

If you would like to discuss your current investments or investing for the first time, get in touch and find out how our team of expert planners can help.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Investment

Investment Trustee

Trustee