In his 2021 Spring Budget, then-chancellor Rishi Sunak froze the Lifetime Allowance (LTA).

The government reported that the move would raise £990 million for the Treasury by 2026, through LTA charges and “lost” tax relief as those approaching retirement stopped contributing.

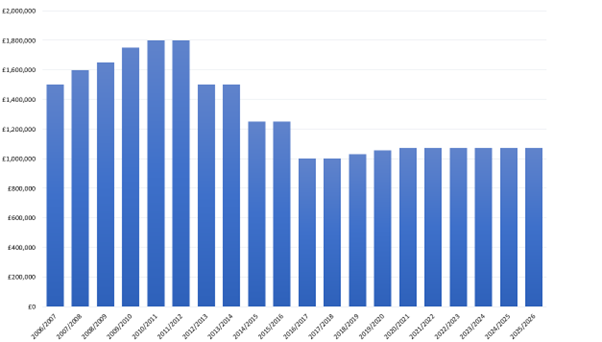

Originally set at £1.5 million – and peaking at £1.8 million – the LTA originally affected mainly higher earners. Now, a recent study, published by Money Age, suggests that the average UK worker is on track to breach the LTA by their standard retirement date.

But what is the LTA, how much is the LTA charge, and what effect could it have on your retirement?

Keep reading to find out.

The LTA is a cap on pension withdrawals beyond which an LTA charge is payable

While there is no limit on the size of pension pot you can build up, withdrawing funds above the LTA will mean those funds are subject to a tax charge.

Withdrawals are tested against the LTA whenever pension withdrawals are made in certain ways, known as “benefit crystallisation events” (BCEs). There are 13 BCEs in all.

When the LTA was introduced in 2006 it stood at £1.5 million, before peaking at £1.8 million. By 2016/17 it had dropped to £1 million.

From the 2018/19 tax year, it began to rise in line with the Consumer Price Index (CPI). This annual rise occurred until the 2021/22 freeze.

Source: HMRC

Keeping the LTA at £1,073,100 will affect many more people, as five years of pension growth approaches the frozen limit. You might find you need to stop contributing or accept the LTA charge.

The LTA charge is payable at 55% on funds exceeding the LTA that you take as a lump sum. You’ll face a 25% liability on excess taken as income.

The average worker could face an LTA charge at age 65

The current LTA freeze means that the number of people inadvertently breaching the allowance is set to rise massively over the next few years.

This includes the “average” UK worker, who looks set to breach the current LTA by the typical retirement age of 64 to 65.

The Money Age report suggests that those with varying salaries or those without a firm grasp on their auto-enrolment contributions could breach the allowance by accident, unwittingly triggering a charge.

Research has found that the top 10% of 18- to 21-year-old earners, with a salary just short of £22,000 and contributing from age 18, could exceed the current allowance by age 57 to 58. Their pension pot at this point, according to the report, would exceed £1.3 million.

Workers on an average salary for this age group – around £12,200 – would exceed the current threshold by age 64 to 65.

Even a modest pension pot could exceed the LTA

Last year, former pensions minister Steve Webb confirmed that “although pension wealth of more than £1 million will seem a huge amount to most people, probably more than a million people of working age can expect to breach that threshold.”

And while a £1 million pension pot might seem large, once you withdraw 25% tax-free cash and factor in the current impact of high inflation, how much will you receive?

If you’re approaching retirement, take the time to track down your pensions and get up-to-date valuations. These should tell you if you’ll be affected.

Remember, the LTA is currently frozen. Any further contributions you make will increase your fund, on top of investment growth. You’ll need to think about how far off your retirement is. Net growth of 5% on a £750,000 pension pot would likely exceed the current LTA in around seven years.

There are many options and Hartsfield Planning can help find the right one for you

If you find that your pension fund is close to the LTA, you have several options. You might consider:

- Stopping or reducing your pension contributions, possibly diverting funds to other investments such as a Stocks and Shares ISA

- Applying for Fixed or Individual Protection 2016, if eligible, which could see you secure a new, higher LTA, thereby reducing the chance of a charge

- Factoring the charge into your retirement plan so it doesn’t come as a surprise and can be incorporated as tax-efficiently as possible.

There is no one “right” answer and the best decision for you will depend on your circumstances now, and those as you approach retirement.

Get in touch

Hartsfield Planning can help you decide if the LTA will affect your retirement plans, and if so, what to do about it.

If you would like to discuss the LTA or any other aspect of your long-term retirement plans, please get in touch and find out how our team of expert planners can help.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Investment

Investment Trustee

Trustee