Recent figures from the Financial Conduct Authority (FCA), reported in IFA Magazine, suggest that as many as 53% of annuities purchased in 2020/21 were sold by pension companies to their existing customers.

While the FCA blames “misplaced loyalty and inertia”, figures suggest that the financial implications could be huge.

A 65-year-old in reasonable health with a £68,000 pot could miss out on £490 a year (or £12,250 over 25 years) by not shopping around.

At Hartsfield Planning, we can help you to understand your retirement options and ensure you make the right choice – and with the right provider – for you, whether that’s a flexible or regular income or a mixture of both.

An annuity’s regular income can provide financial stability in retirement

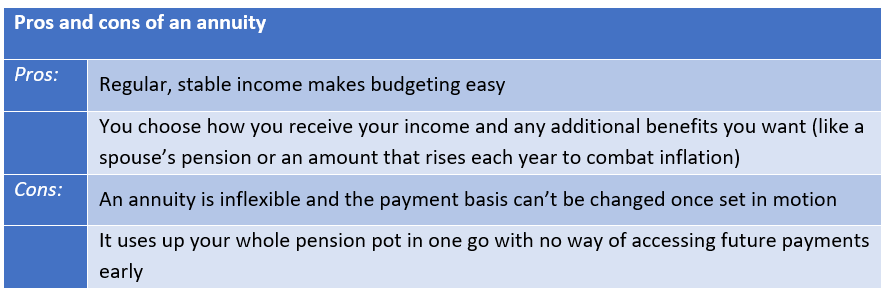

Also known as a “guaranteed income for life (GIfL)”, an annuity offers a regular and stable retirement income that keeps budgeting simple. If you have your retirement mapped out, with no large one-off purchases on the horizon, an annuity can be a great option.

But that doesn’t mean you need to stick to your current provider.

An annuity will usually allow you to receive 25% of your pension pot tax-free, known as a “Pension Commencement Lump Sum (PCLS)” with the rest used to buy your lifetime income.

Different companies will pay different annuity rates and these could make a massive difference to the income you have to rely on for the rest of your retirement. While you might feel a sense of loyalty to a provider you have paid pension contributions to for several years, the FCA acknowledge that confidence of this sort is misplaced.

There is around £4 billion in the annuities market and yet only 33% were sold to new customers in the 2020/21 tax year. Since 2019, your provider has been obliged to show you their best quote, along with the best comparison quote from across the market.

This means shopping around couldn’t be easier and could mean you can live the retirement lifestyle you dreamed of.

Consider flexible options too

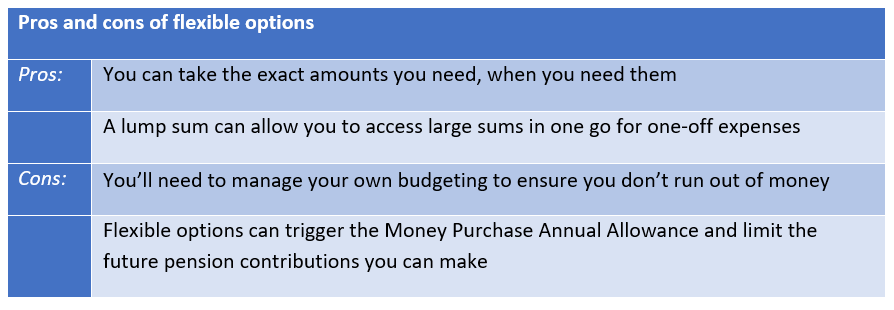

You might choose not to take an annuity and opt for a more flexible option instead. Pension Freedoms legislation means that you can take all (or some) of your pot in one go as a lump sum. You can also use drawdown to make flexible withdrawals while leaving your untapped pot invested.

With both options, you can take 25% tax-free cash but you’ll need to keep track of how you budget with these amounts.

You might find that where you have some fixed expenses, like a mortgage, an annuity is great for paying this, leaving your flexible income free for discretionary expenditure and one-off luxuries like holidays.

The need for pension advice

With so many options – and combinations of options – to choose from, picking the right one for you is crucial.

Weighing up the type of retirement you want, with the right option for that retirement, will allow you to make the most of your pension. At Hartsfield Planning, we can ensure you understand the tax implications of each option and ensure you shop around to get the most out of your pension.

Get in touch

If you would like to discuss any aspect of your pension options or long-term retirement plans, please get in touch and find out how our team of expert planners can help.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Investment

Investment Trustee

Trustee